Biopesticides, Part IV: Market Drivers and Trends

In this fourth article of a series on BioPesticides, I address issues I have experienced while mediating biology to technology-focused corporate decision-makers, and focus on the drivers of BioPesticide Market Drivers and Trends.

A little about my background

I am a plant scientist with a background in Molecular Plant Biology and Crop Protection. 20 years ago, I worked at Copenhagen University on photosynthetic responses to stress in crops. Subsequently, I worked in Australia on molecular defense mechanisms induced by Phylloxera attack in grapevine.

At that time, biology-based crop protection strategies had not taken off commercially, so I transitioned to conventional (chemical) crop protection R&D at Cheminova, later FMC.

During this period, public opinion, as well as increasing regulatory requirements, gradually closed the door of opportunity for conventional crop protection strategies, while the biological crop protection technology I had contributed to earlier began to reach commercial viability.

From January 2018, I will consolidate 17+ years of industry experience in BioScience R&D management with my academic research background, to provide independent Strategic R&D Management as well as Scientific Development and Regulatory support to AgChem & BioScience organizations developing science-based products.

For more information, visit BIOSCIENCE SOLUTIONS – Strategic R&D Management Consultancy.

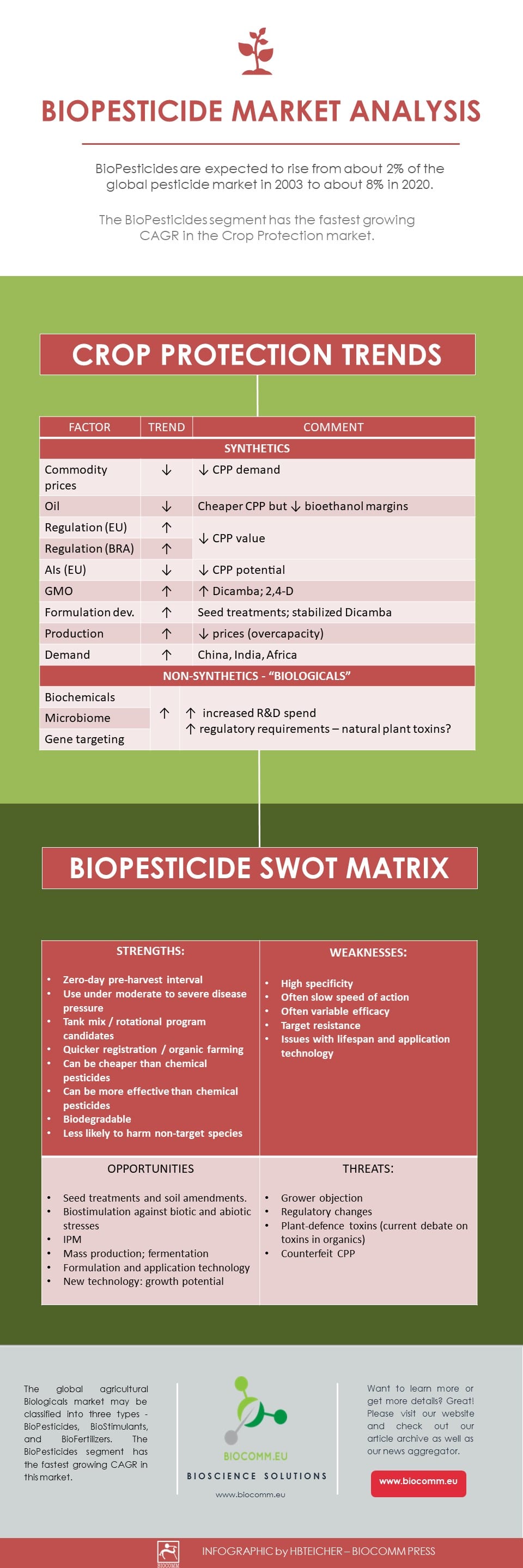

Crop Protection Trends

Estimates of global market sizes for crop protection products (conventional pesticides as well as biopesticides) vary, but the general consensus is that biopesticides are expected to rise from about 2% of the global pesticide market in 2003 to about 8% of the global pesticide market (estimated to exceed 82 billion USD) in 2020. Current opinion is that the compound annual growth rate (CAGR) for biopesticides during this period is expected to exceed 12%, compared to an expected overall pesticide CAGR of about 7%.

Falling commodity prices will reduce the value of crops for farmers, and thus demand for crop protection products. While lower oil prices permit cheaper production, associated declines in bioethanol margins restrict grower willingness to invest in these products.

Synthetics

Pesticide production is increasing to meet demand in rapidly expanding regions such as Latin America, Asia-Pacific and Africa – a potential overcapacity may however lead to a decline in prices.

A few active ingredients, such as Dicamba and 2,4-D are experiencing increased interest, due to trends in GMO technologies (trait stacking) and advances in formulation development (seed treatments).

Stricter pesticide regulatory requirements in the EU and Brazil restrict access and increase registration costs, while a concommitant decline in the number of registered active substances in the EU is reducing the potential of crop protection resistance strategies.

Non-Synthtics; Biologicals

Within the EU, stricter pesticide regulatory requirements, consumer awareness regarding hazards caused by chemical pesticides and the phasing out of toxic conventional pesticides are factors driving the growth of the biopesticide market.

The leading AgChem companies are expanding their biopesticide R&D and portfolios, with focus on biochemicals, such as naturally-occurring metabolites with entomopathogenic or antifungal activities, microbiome (beneficial microbes which improve nutrient uptake and disease resistance in crops), and molecular biological techniques (gene targeting), such as CRISPR and RNAi.

Potential restraining factors include the current low adoption rates of biopesticides, as well as the expectation of stricter future regulatory requirements for biologicals.

Of utmost importance with respect to toxicology, the formation of plant-produced toxins induced by biopesticides requires immediate attention. Recently, natural toxins in organic produce have been the focus of public attention in Denmark – these toxins may be pathogen metabolites, or the products of plant defence responses.

Factors affecting the BioPesticide Market

The following SWOT (strengths, weaknesses, opportunities, and threats) matrix identifies factors favourable and unfavourable to the development and application of biopesticides in crop protection strategies.

STRENGTHS

A zero-day pre-harvest interval is of considerable benefit for producers of high value crops, such as greenhouse vegetables, orchard crops and grapevines, by extending existing crop protection strategies to allow the control of late-season diseases. Biopesticides are generally biodegradable, leave no harmful residues (easier residue management) and are less likely to harm non-target species. Biopesticides may be incorporated in tank-mix or rotational programs with conventional pesticides (to obtain additive effects or synergies, or as part of a resistance strategy), or used as standalone applications.

Biopesticides may be effective at moderate to severe disease pressures, and can be as effective as conventional chemical pesticides. They can be cheaper than chemical pesticides when locally produced, and biopesticides are currently quicker and cheaper to register than conventional pesticides.

OPPORTUNITIES

Biofungicidal seed treatments are particularly suitable for the direct control of soil- and seed–borne pathogens. Furthermore, biopesticides may stimulate plant defence responses, which can increase the tolerance of treated crops to biotic as well as abiotic stresses.

Many biopesticides can be effectively produced using fermentation techniques, and may be applied in a manner similar to chemical pesticides, thereby providing innovation opportunities within existing formulation and application techniques.

The growth potential of new biopesticide technologies is considerable – the market share of biopesticides is expected to rise from 2% of the global pesticide market in 2003 to 8% in 2020.

The increased public awareness of the benefits of Integrated Pest Management (IPM) strategies, which combine the use of biopesticides with natural predators, pest-resistant varieties, cultivation techniques and conventional crop protection chemistries. An increased understanding of plant defence responses and plant–plant communications systems, as well as of abiotic and biotic factors, such as weather patterns and disease distribution kinetics, will allow us to develop early-warning protective biocontrol strategies to communicate and work together with crops to reduce production losses.

WEAKNESSES

The high specificity of some biopesticides requires an advanced understanding of pest/pathogen biology and dynamics on the part of the user – producers will increasingly need to provide this information to their commercial staff, as well as to distributors and customers.

Biopesticide efficacy is not only determined by the ability of microbial metabolites to control diseases and pests, but also by the induction of plant defence responses prior to pathogen attack. Plant defence responses are, however, not initiated until pathogens are detected, due to the energy costs of their induction and maintenance. Biopesticides thus often have a slow speed of action, and have protective rather than curative activity, making them unsuitable if a pest or disease outbreak is an immediate threat to a crop.

Living organisms evolve and increase their resistance to biological and conventional control products, and strict anti-resistance measures must therefore be maintained.

Variable biopesticide efficacy (often cited as a key weakness) is in part due to the influences of various biotic and abiotic factors, and in part due to a lack of biological understanding of the effect of these influences on efficacy – more than ever, it is up to producers to mediate this information to their customers.

In addition, biopesticides require optimal storage facilities, a good understanding of the effect of storage on product viability as well as strict adherence to label recommendations in order to maintain the required shelf life and efficacy.

THREATS

Adoption rates for biological pest control are currently low, as the majority of growers still tend to prefer familiar conventional pesticides, in part due to reports of variable efficiency and slow speed of action. Due to their slow speed of action, biopesticides are generally protective, rather than curative. Growers on the other hand have a tendency to wait until the onset of symptoms before investing in crop protection, and thus require products with a certain level of curative activity. The adoption of new agricultural practices – including biological pest control – by growers will depend on factors such as practicality, economics and political pressure, as well as on an understanding of the factors driving the efficacy of biopesticides.

The probable introduction of stricter EU and National regulations can be expected to restrict the growth of the biopesticide market. A particular threat in this respect is the increasing focus on natural plant toxins, which may be produced through the induction of plant defence responses by biopesticides.

In other articles in this series I focus on the interface between biological and conventional crop protection, analyse their current viability, define Agricultural Biological terminology and discuss drivers of BioPesticide efficacy.

Harry Teicher is the founder of BIOSCIENCE SOLUTIONS and an Authorpreneur, providing organisations with Strategic- and Project Management as well as Development & Communication solutions. Follow him on Linkedin, Twitter and Facebook.